Norbert Michel and Jerome Famularo

Previous Cato at Liberty posts have demonstrated that increased trade with China did not decimate US manufacturing. By multiple metrics, US manufacturing is stronger than ever, and increased productivity has meant that fewer people can produce more things throughout the post-WWII period. (This productivity phenomenon occurred all over the developed world, even in China.)

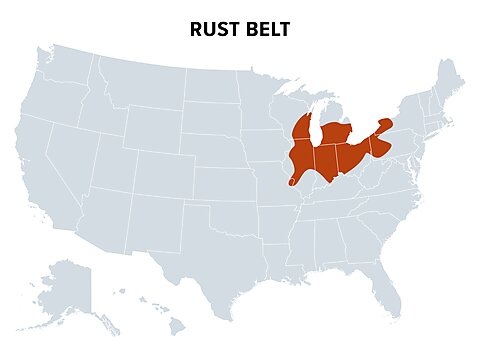

Even the job losses concentrated in the so-called Rust Belt states, whatever their cause, were offset by new jobs in the South. The net effect made Americans richer, and policies designed to shrink trade will only make Americans poorer.

This post takes another look at the Rust Belt states.

There is no doubt that the region has many visibly shuttered factories and cities and towns with population declines. However, even this phenomenon is nothing new. Ghost towns commonly popped up in the United States before World War II, and even before the Civil War, when small towns folded because the single industry they were dependent upon—often some type of mining or agriculture—dried up.

The key question is whether people from the Rust Belt and surrounding areas have grown poorer or richer over time.

One way to answer this question is with US Census data that provide annual personal income by place of birth and residence. This feature allows us to examine the (inflation-adjusted) median personal income for Americans who were born in the Rust Belt and still live there. It also lets us compare income for those who were born in the Rust Belt and left, those who were born outside of the Rust Belt and still live there, and those who were born outside of the Rust Belt but migrated there.

As Figure 1 shows, all four groups showed substantial income growth between 1960 and 2023, completely contrary to the notion that income stagnated or declined. The highest-earning group among these four is those who were born in the Rust Belt and moved elsewhere, i.e., the Rust Belt diaspora. Thus, being from the Rust Belt can hardly be seen as an impediment to success—on the contrary, many people from the Rust Belt have been seeking and attaining success elsewhere.

Those born and living in the Rust Belt had an edge over those born elsewhere (whether living in the Rust Belt or elsewhere) from 1960 until 1980. However, since 1990, the difference among these three groups has narrowed. Furthermore, income growth across all regional groups holds whether we look at workers with or without a college degree.

As Table 1 demonstrates, people who were born in and are living in the Rust Belt now earn 56 percent more real income in 2023 compared to 1960. Yet, those Americans who migrated to the Rust Belt enjoyed even more real growth (81 percent), suggesting that the “rust” in the Rust Belt was not what the name implies. Furthermore, the Rust Belt diaspora and those who were born and are living elsewhere enjoyed even greater income growth, at 94 percent and 110 percent, respectively.

As Figure 2 shows, similar growth patterns exist for both those with and without college degrees, but there is a clear income benefit, known as the education wage premium, for those with a college degree. While many populist critics insist that manufacturing used to provide “good” jobs for those without a college degree, it is particularly noteworthy that a large education wage premium existed even in 1960.

For instance, even in 1960, those born in the Rust Belt and living in the Rust Belt earned nearly twice as much if they had a college degree ($22,833 vs. $45,291). Though the wage premium in that group is higher in 2023 ($30,000 vs. $65,000), such a widening gap should be expected in the United States, a large society that has grown wealthier and more advanced.

While it should go without saying, it’s hardly surprising that more people started going to college after 1960 with such a large wage premium. And it would now make little sense, as it would have in 1960, to implement policies aimed at helping people stay less educated. Boosting manufacturing jobs and wages for those without a college degree, for example, would not help create the workforce needed in the modern world. It would, however, fail to create more of the wealth and prosperity that the modern labor force has produced.

Regardless, Figure 2 also demonstrates that income went up for all groups and that the non-college Rust Belt diaspora (those born in the Rust Belt who moved elsewhere) still outearns all other non-college groups. And, as seen on Table 1, non-college workers who were born in the Rust Belt and are living there had the lowest growth (31 percent), while those who were born elsewhere and live elsewhere had the highest growth (64 percent), with the educated Rust Belt diaspora a close second (61 percent).

However, among those workers without a college degree, those who migrated to the Rust Belt had much higher growth (51 percent) than those who were born in and remained in the Rust Belt (31 percent). Again, these growth statistics paint a very different picture of what’s occurred in the Rust Belt than what today’s populist critics suggest.

To be charitable, it is possible that many critics have missed just how many more people obtained completely different skills in college as productivity and income increased between 1960 and 2023. This shift radically changed the workforce.

In 1960, only 8 percent of the workforce had a college degree. Fast forward to 2023, and 35 percent of the workforce has a college degree. In the 1960s, almost half of Americans over 25 had not even finished high school, a number that has plunged to less than 10 percent.

Thus, at the very least, the workforce and the jobs—not just manufacturing jobs—that now exist are very different from 1960. Even leaving aside the education wage premium in 1960, as well as the harmful wage effects of remaining less educated, it makes little sense to implement policies that try to recreate the labor market conditions of 1960.

Populists may want to bring back those factory towns, but most Americans are too busy enjoying the prosperity of the 2020s. Unfortunately, surveys regularly show that most Americans have a faulty view of other Americans’ level of prosperity, making it easier for populist politicians to continue scoring points by promoting harmful policies.

For more on manufacturing’s supposed decline, and why populist policies will make things worse, check out our new book, Crushing Capitalism: How Populist Policies are Threatening the American Dream.