After a relatively quiet week for the S&P 500, we’re seeing some interesting shifts in sector dynamics. Let’s dive into the latest rankings, RRG analysis, and what it means for our portfolio strategy.

Sector Shifts and RRG Insights: Materials on the Move

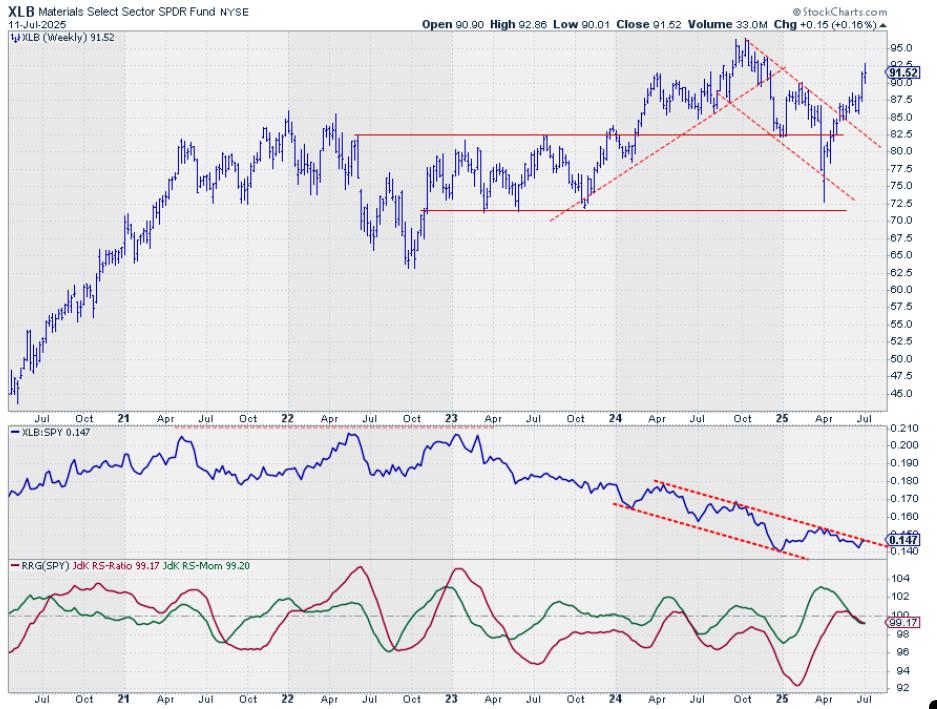

The big news this week is the ascent of the Materials sector, which has muscled its way into the top five at the expense of the Utilities sector.

The rest of the top five remained steady, but we’re seeing some movement in the lower ranks as well. Consumer Discretionary made a notable jump from #9 to #7, pushing Consumer Staples and Real Estate down a notch each. Energy and Health Care continue to bring up the rear at #10 and #11, respectively.

- (1) Technology – (XLK)

- (2) Industrials – (XLI)

- (3) Communication Services – (XLC)

- (4) Financials – (XLF)

- (6) Materials – (XLB)*

- (5) Utilities – (XLU)*

- (9) Consumer Discretionary – (XLY)*

- (7) Consumer Staples – (XLP)*

- (8) Real-Estate – (XLRE)*

- (10) Energy – (XLE)

- (11) Healthcare – (XLV)

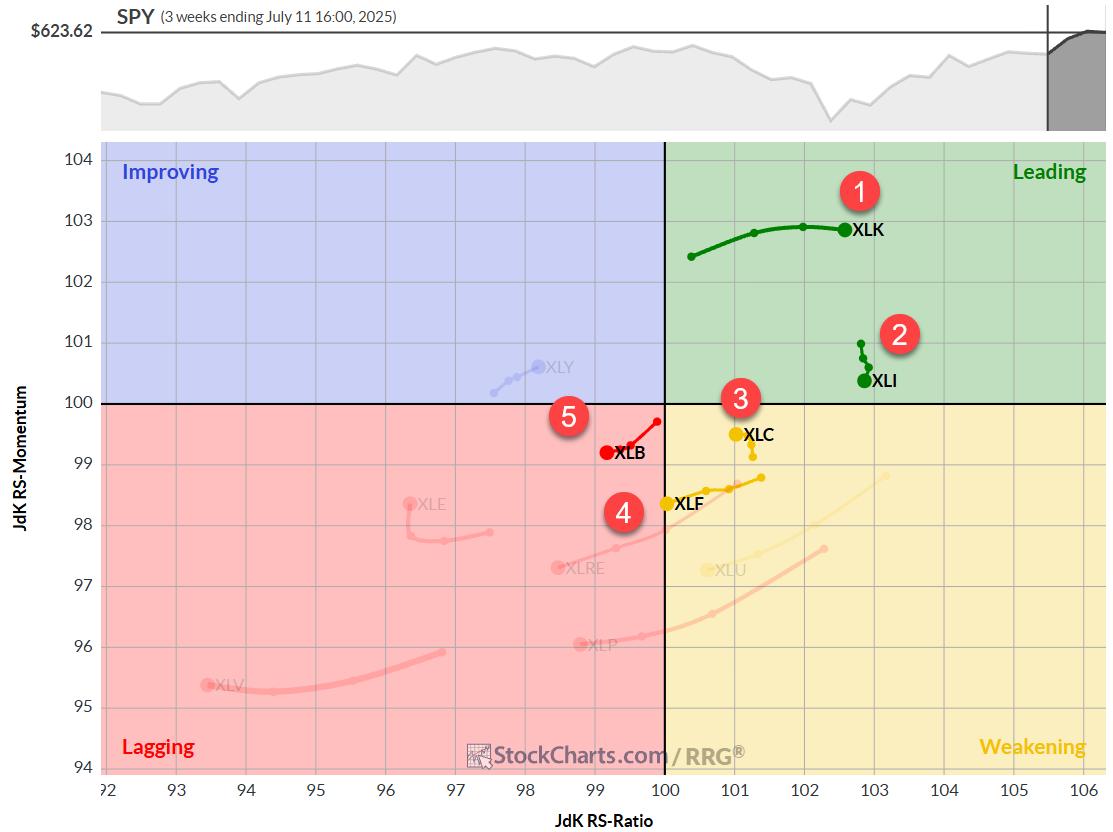

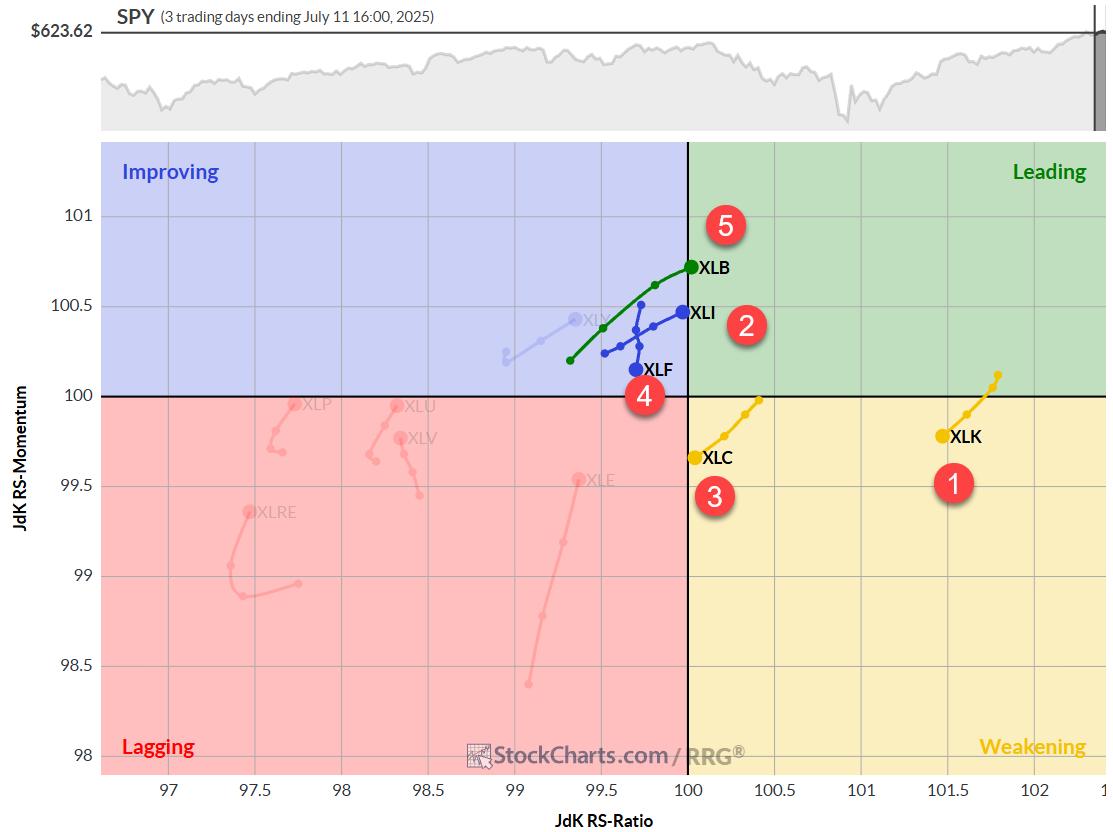

Weekly RRG

The weekly Relative Rotation Graph (RRG) gives us a broader perspective on sector trends. Technology continues to dominate, firmly entrenched in the leading quadrant, no surprises there.

Industrials is showing stability with a short tail in the leading quadrant, indicating a consistent relative uptrend.

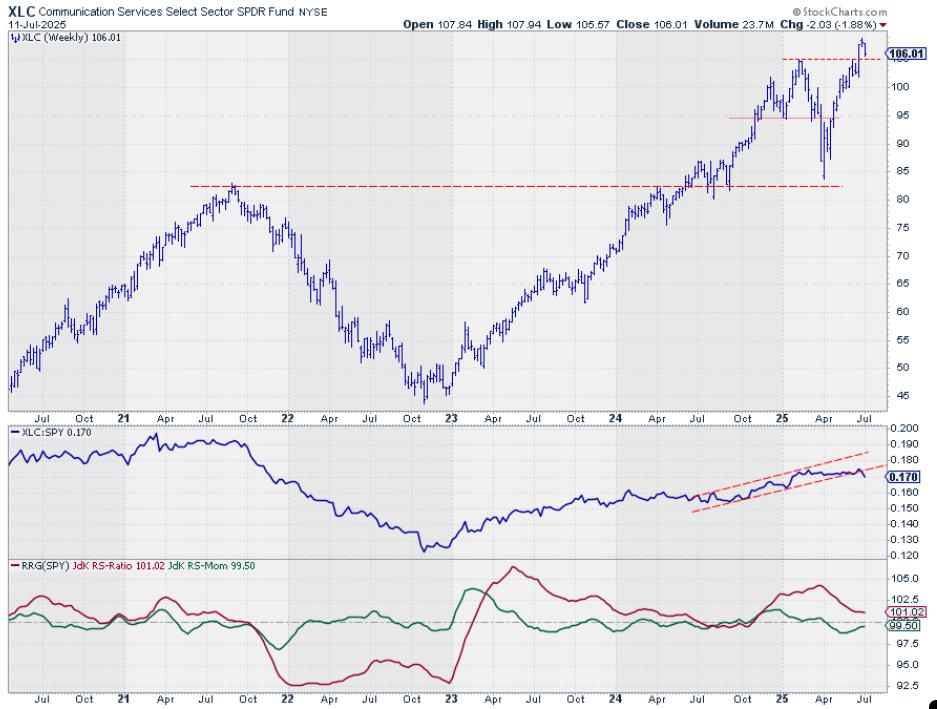

Communication Services, however, is raising some eyebrows. It’s lurking in the weakening quadrant with a short tail, suggesting a stable relative uptrend but with negative momentum.

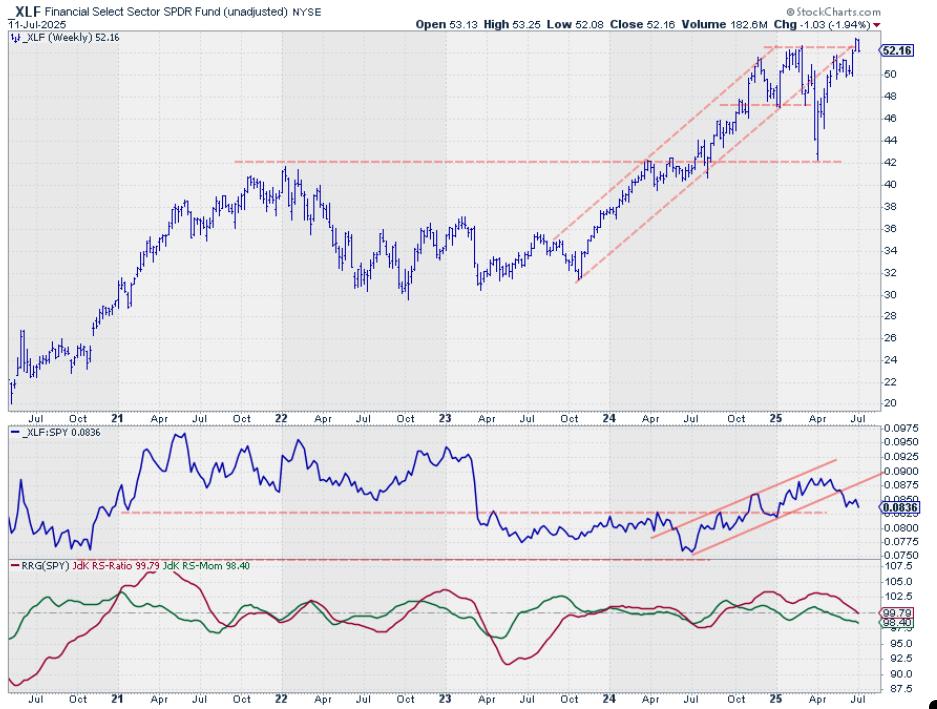

Financials are teetering on the edge of the lagging quadrant, a move that demands attention.

Materials, despite its rise in the rankings, is actually in the lagging quadrant on the weekly RRG. You will see why it made its way into the top 5 on the daily RRG.

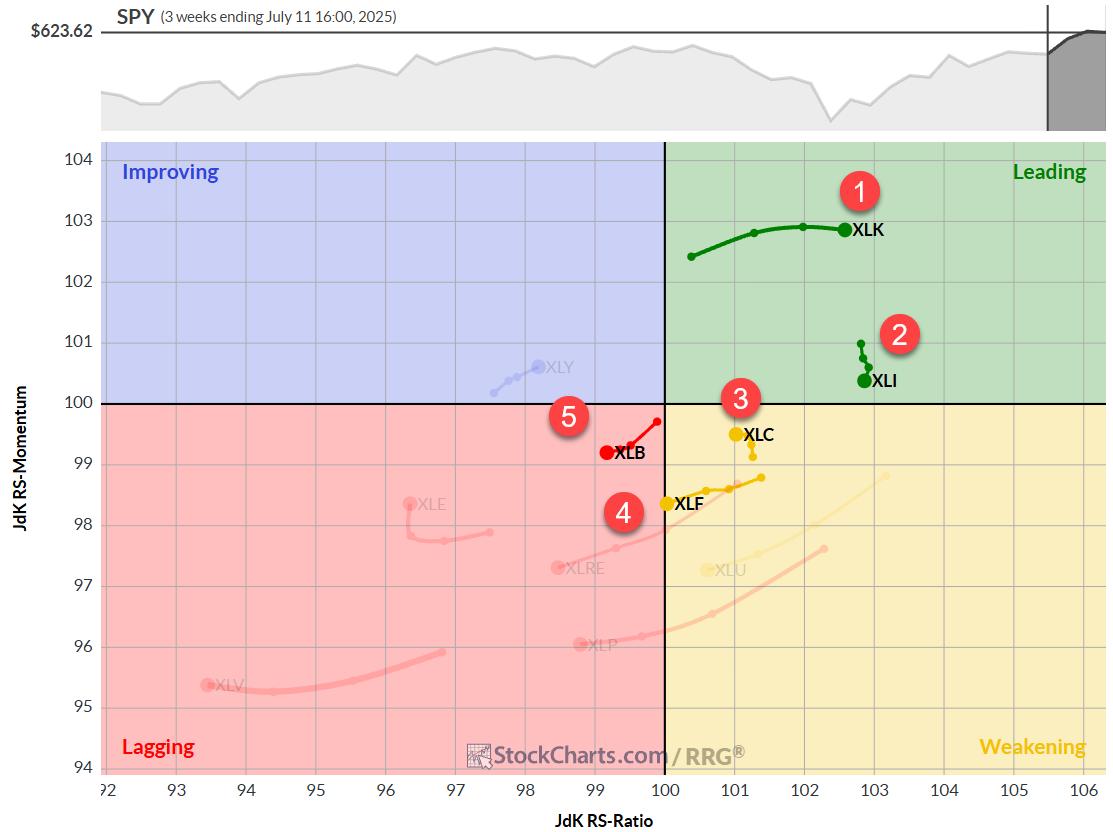

Daily RRG

On the daily RRG, we get a more nuanced picture of short-term sector movements:

- Materials (XLB) is the star of the show, crossing into the leading quadrant and standing alone in that coveted space.

- Financials (XLF) is showing weakness, rolling over and heading back towards the lagging quadrant — confirming what we saw on the weekly chart.

- Communication Services is on the verge of crossing into the lagging quadrant, a sign that is not great for its current #3 ranking.

- Industrials is flexing its muscles, approaching the leading quadrant with a positive heading.

- Technology, while rotating into the weakening quadrant, still has ample room to bounce back into leading territory.

Technology

The tech train continues to roll, breaking through resistance around 240 and maintaining its upward trajectory in both price and relative strength. The RS line is pushing higher after a clean breakout from its falling trend, a bullish sign for the sector leader.

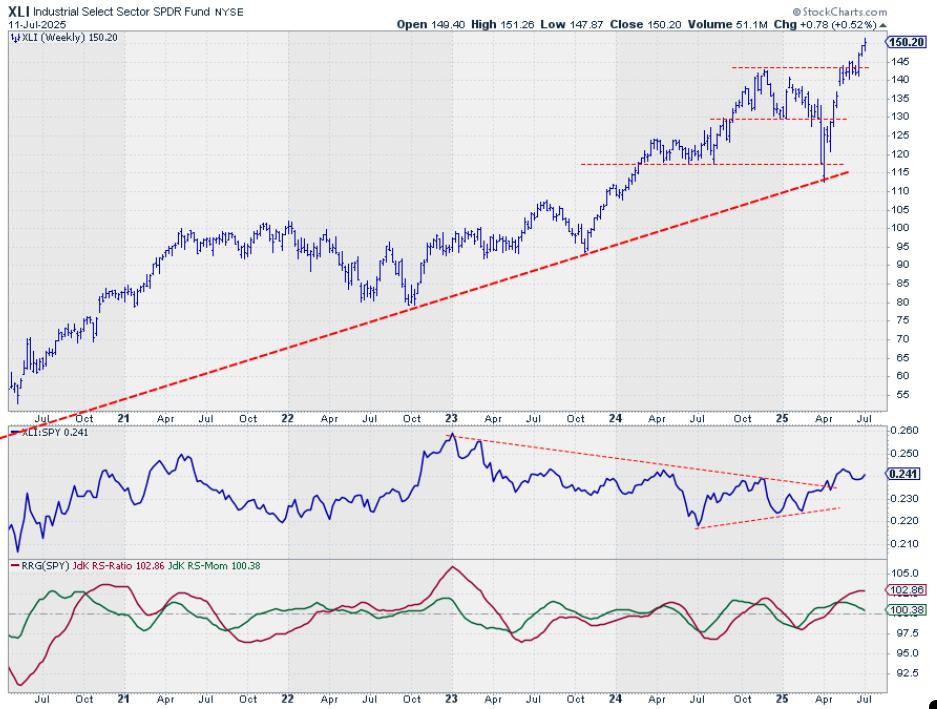

Industrials

XLI is following through nicely on both price and relative strength charts. The raw RS line has established a new higher low, dragging the RS ratio higher. In my opinion, this sector looks rock-solid.

Communication Services

Here’s where things get dicey. XLC is clinging to its breakout above 105, but last week’s decline is testing that former resistance as new support. The raw RS line breaking below rising support is a warning sign, this sector could be in for a bumpy ride.

Financials

Similar to Communications Services, Financials has retreated to test old resistance as support. The raw RS line looks even worse here, having broken out of its rising channel weeks ago. Both RRG lines are flirting with the 100 level; a further push into the lagging quadrant seems likely.

Materials

XLB is showing some muscle, breaking out of its falling channel and taking out recent highs. The raw RS line is pushing against falling resistance — if it can break through, we could see a significant turnaround in the RRG lines, confirming the sector’s newfound strength.

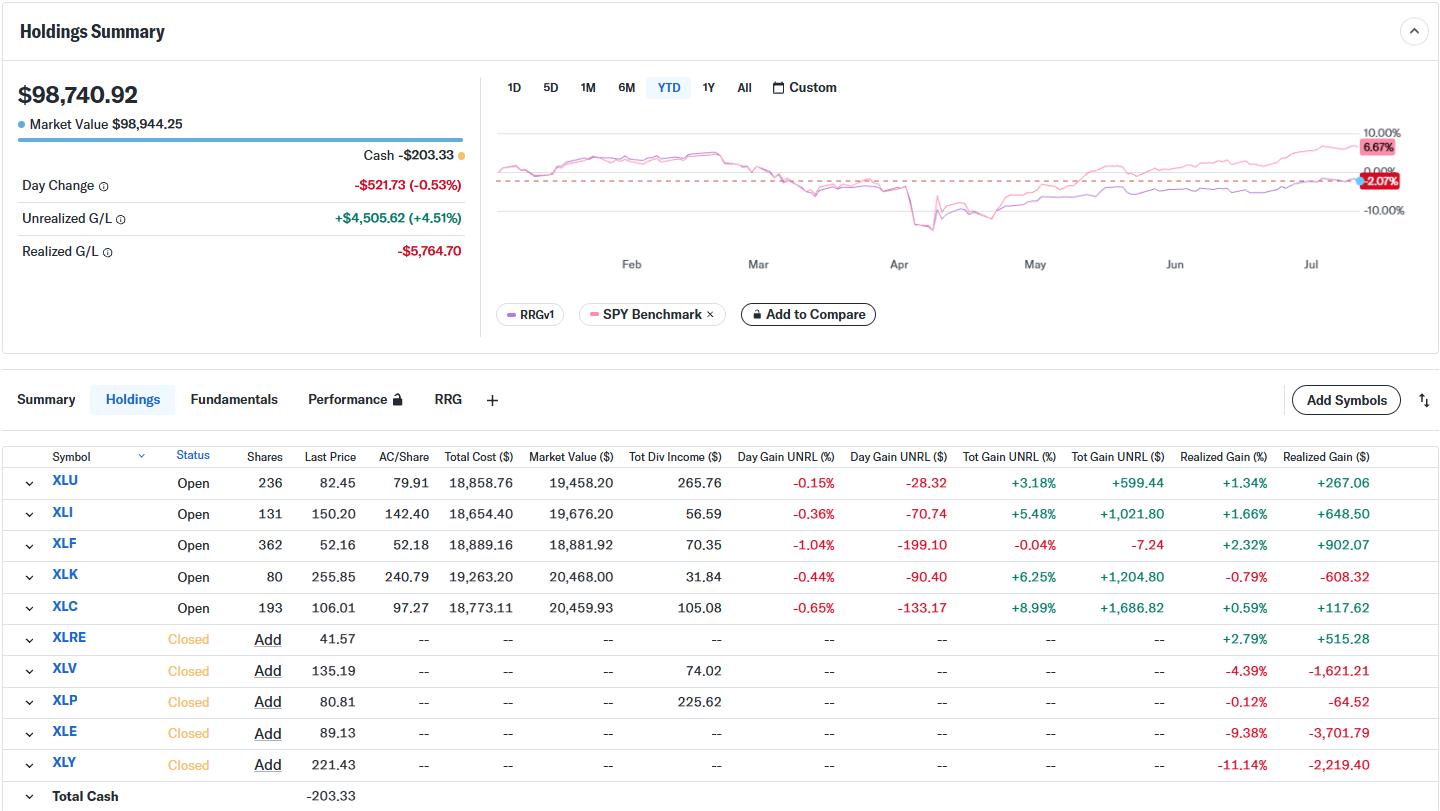

Portfolio Performance

Now, for the part that might sting a bit, the portfolio drawdown is ongoing. It’s something trend followers need to learn to live with. Currently, the portfolio is down about 2% for the year, while the S&P 500 is up over 6%. That puts us roughly 8% behind the benchmark YTD.

It’s not a comfortable position, but it’s part of the game. Trend-following strategies often lag in choppy or rapidly changing markets. The key is to stay disciplined and trust in the long-term efficacy of our approach.

#StayAlert and have a great week, Julius