Washington’s international economic policies have increasingly turned inward over the last decade, prompting trading partners to look elsewhere for further economic integration. As the ever-erratic Trump administration threatens and implements new tariff measures on exceedingly weak grounds—even in the face of falling equities markets and increasing inflation expectations—US trading partners will increasingly reassess the value of pursuing new free trade agreements (FTAs) with the United States.

Undermining Certainty

FTAs help facilitate certainty in international commerce by establishing clear rules, eliminating tariffs, and providing neutral dispute resolution. Consumers, including firms, benefit from lower prices and expanded varieties. Likewise, predictable access to foreign markets reduces the risk for firms looking to build factories and other infrastructure, establish diversified supply chains, and hire workers. This relative certainty drives investment and enhances prosperity.

When looking for FTA partners, countries seek stable, predictable trading partners with large consumer markets. For nearly 70 years following World War II, the United States fit the bill. Policymakers leveraged the country’s outsized position in the post-war global economy to create rules and institutions that allowed international trade and investment to thrive, benefiting much of the world and the United States in particular.

Yet for nearly a decade, Washington has engaged in increasingly reckless international economic behavior. It impulsively withdrew from the Trans-Pacific Partnership (renamed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or “CPTPP”), a promising trade pact with Pacific Rim nations designed to establish high-quality economic rules in the Asia Pacific region while offsetting China’s gravitational pull; it levied ridiculous “national security” tariffs on steel and aluminum imports from longstanding allies; and it unilaterally crippled the World Trade Organization’s (WTO) dispute resolution system.

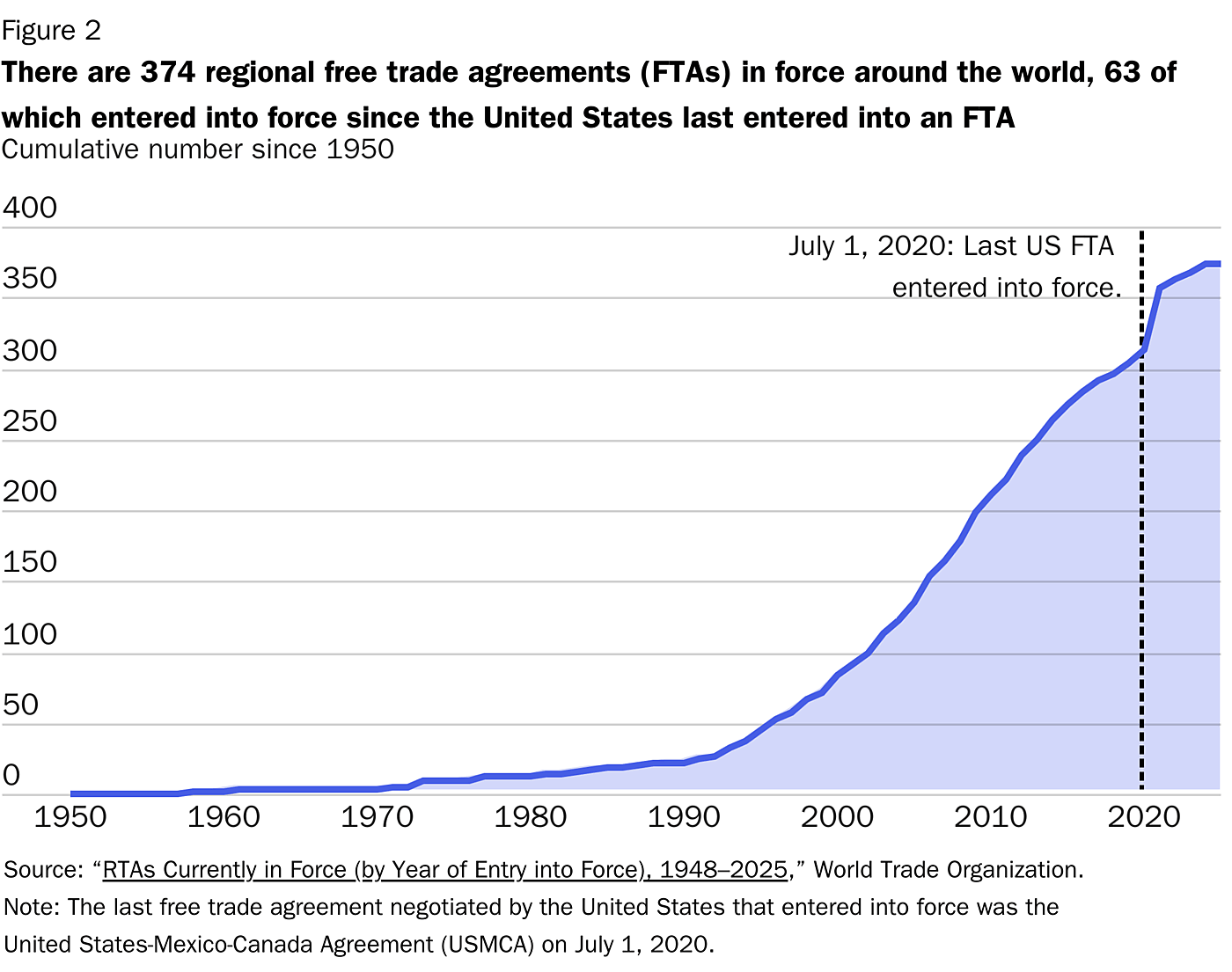

Such moves have not been accompanied by offsetting attempts at trade liberalization. It has been nearly 15 years since the United States negotiated and ratified an FTA.

Now the Trump administration is considering more regressive measures, threatening and imposing various tariffs on long-time close trading partners and allies for bizarre reasons.

The recent tariff threats and actions against Canada and Mexico are particularly farcical. The tariffs hit the United States’ closest neighbors and longstanding FTA partners in direct contravention of the spirit, if not the letter, of President Trump’s own US-Mexico-Canada Agreement.

The erratic and unfounded tariff announcements shatter the certainty FTAs are designed to facilitate. And the Trump administration isn’t done.

US talk of “reciprocal” tariffs on each country with which it trades is pushing trade policy uncertainty to new extreme highs (Figure 1). If Washington is willing to tear up binding trade agreements with close allies and longstanding trading partners on exceedingly weak grounds, it’s doubtful many countries will be lining up anytime soon to negotiate new FTAs with the United States. The reluctance will likely linger well after the Trump administration is gone.

Simply put, the United States is no longer a reliable trading partner.

Alternative Trading Blocs Gain Appeal and the Costs of Protectionism

In contrast to Washington’s approach of erecting fresh trade barriers, alienating allies, and turning inward, other countries are increasingly moving forward with more integration. Trade and investment blocs that exclude the United States continue to proliferate.

As of 2024, WTO numbers show more than 370 regional FTAs in force worldwide (Figure 2). As the United States puts new trade barriers in place, the rest of the world continues to pursue expanded economic integration through agreements like the CPTPP and a blockbuster 2024 trade deal between the European Union and the Southern Common Market, commonly known as Mercosur (which includes Argentina, Brazil, Paraguay, and Uruguay), as well as other regional and bilateral agreements.

These regional and bilateral FTAs are imperfect. By lowering tariffs and other trade barriers on only a relatively narrow set of countries, FTAs can divert trade from more efficient exporting countries to less efficient ones that are part of the trade agreement—a process economists call “trade diversion.” Still, these arrangements are preferable to no liberalization at all or, even worse, galloping protectionism such as in the United States.

Given these risks, FTAs should be judged on their own merits. Though often containing too much baked-in protectionism, the benefits of such agreements outweigh their downsides.

There are also longer-term costs to Washington’s retreat from trade liberalization and ignorant protectionism that must be considered.

Higher prices for American consumers are one obvious starting place. Likewise, US trade protectionism will put downward pressure on real wages since increased trade tends to promote specialization and enhance productivity. Meanwhile, American exporters face higher barriers than competitors in countries that participate in free trade deals. Higher barriers to trade will also mean a less innovative and dynamic ecosystem for existing firms, which are increasingly shielded from foreign competition.

In less concrete terms but arguably just as important, the US is incinerating a vital tool of soft power to set standards around the world in emerging areas vital to the 21st-century economy. The vacuum being created will surely be filled by others. The European Union increasingly sets heavy-handed regulatory standards that many global firms follow, a phenomenon known as the Brussels Effect. China and others will continue to fill the void as the United States retreats inward.

In short, the US is forfeiting the power and prestige it earned for cultivating today’s successful trading system while alienating close allies along the way.

Regrettably, there’s no end in sight. Ultimately, today’s boorish trade policy will likely haunt the United States long after the Trump administration exits the scene.